The opening sentences of many things you might have read in the last year were likely lamentations. Of losses economic and social. Of course, we would have loved to sing a different tune but that would prove to be hypocritical and smack of an inability to read the room.

Much more, such a disregard of the realities of the past year would be an ultimate dishonor of those who bowed out of it. Many people, regardless of generation, would attest that 2020 was the year they were most confronted with the reality of their humanity relative to all existence. It is also the year that many corporations were awakened to the entirety of the being of the people who work with them. Long-simmering upheavals broached the veneer of avoidance in many countries. Nigeria shook1. Hong Kong shook2. The United States shook. And still shakes.

Yet, through all the haze, there have been sublime beams of light for the collective and the individual. Staying put, we saw clear blue skies in New Delhi, the breathtaking turquoise of the canals in Venice, and sightings of rare birds in the concrete jungle of New York. These and many other swift, but staggering changes brought into stark relief the urgency of our need to build a more sustainable planet. They were also the chink that was needed to settle the fact that if we acted now, en masse, a climate resilient, somewhat restored world was possible3. The understanding bloomed that if not for the thriving of humanity and all that breathes, then what does the bottom-line matter?

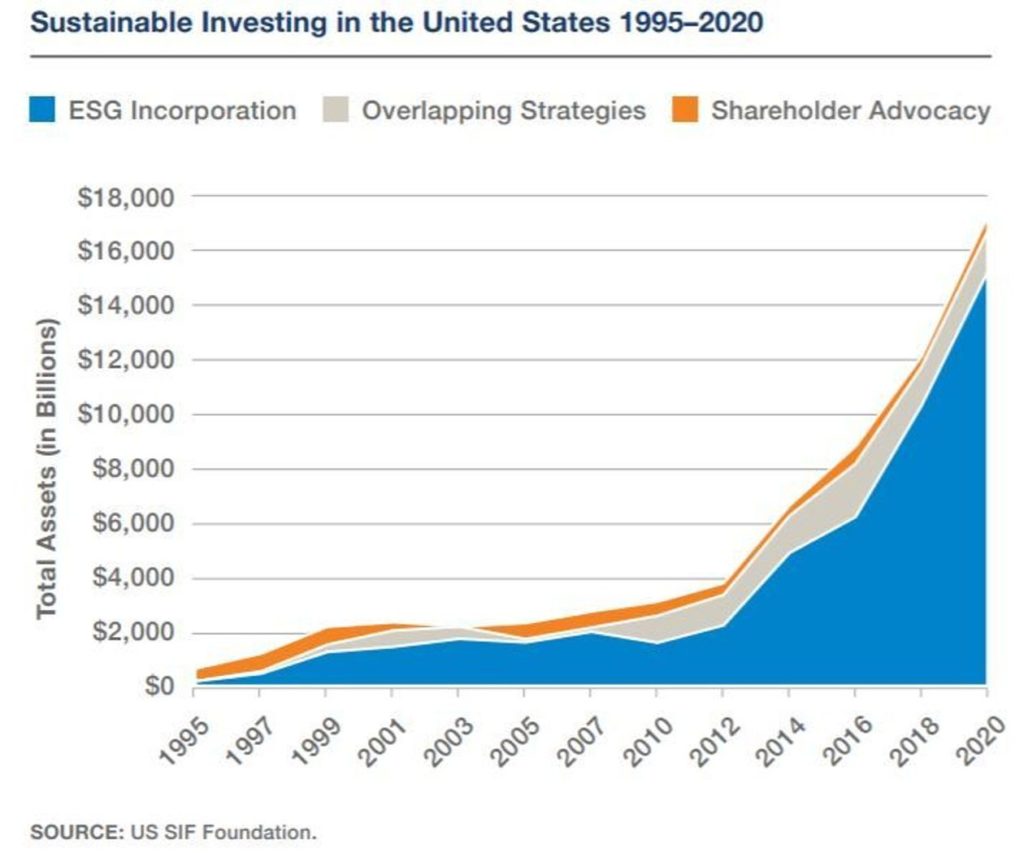

Against this backdrop, we witnessed a momentum for what we have come to call “the great capital pilgrimage”4. Whether for true belief and concern, shallow posturing, or a fear of missing out we have seen a tremendous increase in the desire for sustainability investments, most especially towards climate change. Several researches and reports have been released by reputable outfits with evidence of this. There has been a growth in knowledge and resources, the enactment of policies and passage of laws, the formation of coalitions benign and aggressive, all pointing to an almost universal agreement that the fight against adverse global warming is in full swing now. Business as usual is portentous and a diversion from it is critical5.

As members of the infantry, we have invented effective tools based on the solid foundations of climate science, data science, economics and finance. We introduced into the market our Smart Climate® Technology based on the Entelligent E-Score®. This highly adaptable, equities-compatible product has the valuable characteristic of being predictive. It has helped asset owners and managers spot the equities in their portfolios that have the most climate risk resilience and optimize accordingly. The success of our flagship product has been characterized by important client relationships and partnerships such as the Société Générale Global Markets Incubator Program out of which has been launched the SG Entelligent Agile 6% VT Index with Investors Heritage6. The United Nations Joint Staff Pension Fund7, one of the earliest adopters of our tool continues to trust the efficacy of our E-Score®. Together with S–Network, the Smart Climate® Risk 50 Index was launched8. Another momentous partnership is with FactSet, who now hosts our data base and serves as a portal that allows clients a limited period of free trial and then a subscription that gives them access to the E-Score® tool9. The inroads we have made with E-Score® has inspired the development of other products like the Carbon Evaluation+ product, and the Transition Risk and a Fixed Income products still hot in the works.

While there was a general turbulence in the world economy, we are grateful to have had an expansion and enrichment of our human resource. Our multicultural, cognitively diverse team welcomed 3 individuals with valuable, different lived experiences, heritages and a spectacular cocktail of skillsets each. We are especially thrilled that each of these individuals hold a deep, genuine interest in sustainability and climate change. We look forward to adding on to our team in the coming months as we play our role in helping the world navigate the unfamiliar terrain it is in.

As we look into the decade, nothing is louder than the echo from 2020 that tomorrow is not promised, but it is definitely certain so we must plan for it. So, while anticipating the end of the carryover turmoil of the past year, we need not lose sight of the fact that our goal as a species should be to thrive on this earth. Empty streets are tolerable for a few hours, but human activity should have to not cease before we see clear skies over New Delhi. We need to be more proactive in our climate change solutions, and driving capital -as we help investors do- is one sure way to achieve this.

The sobering of the world in 2020 should make a lot more of us ask, “…why not also dream of a way for nature to prosper that didn’t depend on our demise? We are, after all, mammals ourselves. Every life form adds to this vast pageant. With our passing, might some lost contribution of ours leave the planet a bit more impoverished? Is it possible that, instead of heaving a huge biological sigh of relief, the world without us would miss us?” (Excerpt from “The World Without Us” by Alan Wiesman).

We at Entelligent have asked this and had our resolve to align the capital markets with the needs of the 21st century, and in particular, the systematic risks of climate change strengthened tremendously. It is our sincere hope that you have, too, and that you heed to the clarion call to build a more sustainable earth while we are still on it.

Nana Yaa Asante-Darko

Client Relationship Administrator, Entelligent.

[1] https://en.wikipedia.org/wiki/End_SARS

[2] https://en.wikipedia.org/wiki/2019%E2%80%9320_Hong_Kong_protests

[3] https://www.ipcc.ch/site/assets/uploads/2018/02/AR5_SYR_FINAL_SPM.pdf

[4] https://www.ussif.org/files/Trends%20Report%202020%20Executive%20Summary.pdf | https://www.marketwatch.com/story/esg-investing-now-accounts-for-one-third-of-total-u-s-assets-under-management-11605626611

[5] https://www.oecd.org/env/cc/43707019.pdf

[6] https://investorsheritage.com/app/uploads/2020/09/2020.09.23-SG-Entelligent-Agile-6-VT-Factsheet-Pager.pdf

[7] https://oim.unjspf.org/report/unjspf-press-release-strategic-partnership-with-entelligent/

[8] https://snetworkglobalindexes.com/newsview/180/s-network-and-entelligent-launch-new-index-targeting-companies-best-able-to-adapt-to-a-carbon-free-environment

[9] https://open.factset.com/products/smart-climate-e-scores/en-us