Dear Climate Finance Stakeholder,

Even as I write this, sweltering under the record “heat dome” and drought conditions hanging over the Western United States, I am finding myself hopeful on several fronts. Even our climate future.

My optimism centers on the impression that science has begun to reassert itself.

From an Entelligent perspective, the transition to the Biden Administration was not a revolution by any means but a signal of change and the United States’ return to participation and leadership in international climate change discussions. One of President Biden’s first acts, of course, was to re-enter the Paris Accord.

And the U.S. has rolled out vaccines to address the COVID 19 pandemic, setting milestones for success domestically and demonstrating a willingness to help globally. Science has made us resilient in a time of a health crisis. I passionately believe the lessons from the health crisis can carry over to using science to avert the worst of the climate crisis.

However, as a climate risk company, we need to remain sober about the urgency. The 2 degrees Celsius, and the more ambitious 1.5 degree Celsius goals set by the Paris Accord are, themselves, barely sufficient. And while there has been increased express commitment to the Agreement, those who have signed on do not have clear transition paths that would help them reach these milestones. Although it is not a complete solution, we believe the Entelligent approach to climate change investing can play a role in the transition, and possibly averting a climate disaster. Our system is forward looking and aligns capital deployment with preparedness, and these are critical features that any climate investing solution must possess.

There are four main takeaways explored in depth in this letter to you:

- Capital inflows to sustainability-aligned funds are poised to explode in the coming months and years, given impending climate and sustainability regulations.

- Scenario-driven analysis, which is the predictive element of the Entelligent approach, is increasingly becoming a standard and can be an essential lever to bend the climate curve.

- We have come a long way with our partners to commercializing our climate risk models and see clear opportunities to drive climate conscious investing with a goal of $50 billion of Entelligent-powered AUM.

- Merger and Acquisition activity in our space is on the rise and proof of a quickly maturing market.

Because of the changing landscape, we can see a better climate future through the lens of science, scenarios, and the Entelligent approach. We find ourselves poised in a moment of astonishing opportunity — and are humbled and grateful.

And as if all of this were not exciting enough, we also landed a slot in Google’s Startup Advisor: Sustainable Development Goals program. This program can provide us with assistance in everything from our machine learning capabilities to our search engine visibility.

The U.S. re-emerges as a climate leader, but what will it mean for climate change?

Watch the international dialogue closely

In November, the U.S. will join the world in Scotland for the 26th meeting of the Conference of Parties (COP 26). It is anticipated that the U.S. will arrive at the scene attempting to resume its historical leadership role. Some may look at the U.S. return with skepticism or cynicism because of what the prior four years have wrought on international trade and climate change coordination. However, it is important to note that the growth in U.S. greenhouse gas emissions has, in fact, declined—a claim that is hard for our international counterparties to deny. Given that all expectations are that China will double its emissions by 2035, this gives the U.S. some moral high ground. Looking back at the 1990’s Kyoto Protocol and Europe’s establishment of a carbon trading system may today look very byzantine, but it could yet represent the way forward for the rest of the world. This was of course an early hope of mine when working on establishing the first carbon credit in the U.S. in the 2000s. Europe has its own achievements, and national efforts to convert to renewable energy have paid off. In May 2021, Europe posted a carbon trade at 50 euros, the highest in carbon trading history. Thus, Europe is providing leadership in the arena of carbon market formation and its status on the world stage. This is an indicator to any investor—even outside of Europe—of the magnitude of the bill that can come due when future consequences become priced into present values.

Scenario Driven analysis is the new standard

Entelligent business proposition proven

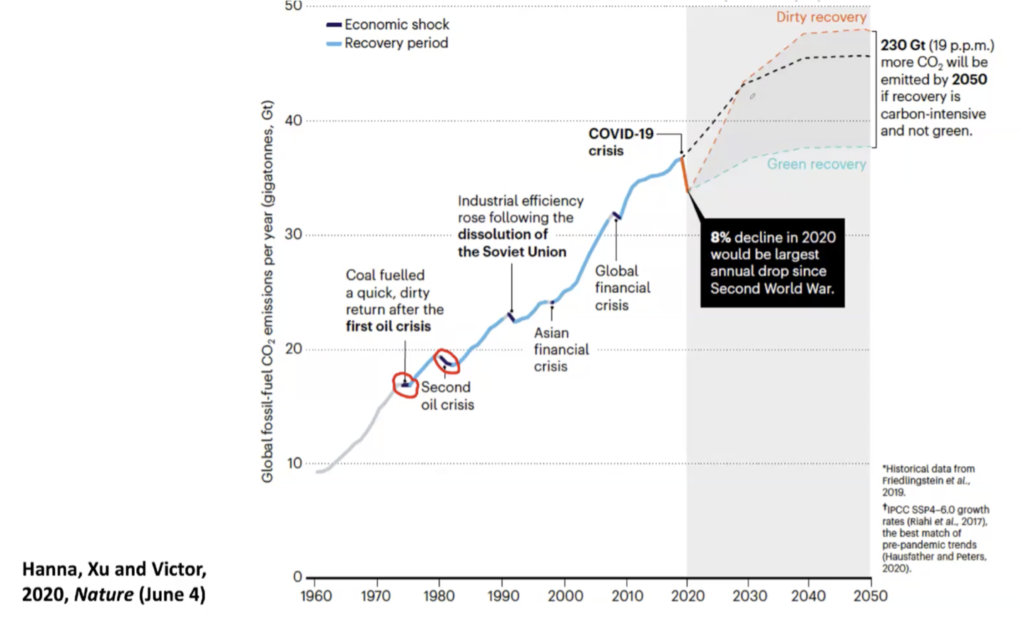

See Figure 1 below, which is a recording of annual carbon emissions dating back to the 1960s combined with a forecast of two scenarios (foreshadowing a “dirty recovery” versus a “green recovery”) post the COVID 19 pandemic. Much depends upon what policies and economic actions are taken today to internalize costs that have been externalized since the very beginning of the industrialized age.

Figure 1.

Our perspective is that carbon pricing is still only a marginal but emerging energy cost worldwide in global climate scenario modeling because a fully integrated price for carbon will depend upon setting national policies and economic goals consistent with the Paris Accord and a 1.5C degree scenario by the end of the century. Therefore, as climate change continues to emerge as a clear and present danger, investors will take notice. Given increased global leadership, carbon pricing could become a material factor in CAPEX and OPEX planning. By the end of this decade, the price could double or more, pushing certain assets to be stranded while markets innovate for carbon capture technologies.

As CEO of Entelligent, I am tracking the international dialogue as a crucial factor to observe and doing so with history in mind. Future growth in global greenhouse gases is not expected to come from the U.S. or Europe but from economic growth in emerging markets. So as the U.S., for instance, invests in new clean energy infrastructure, how will this really impact the growth in global emissions and the infrastructure in emerging markets? We think the tone of international discussions around climate change mitigation and international agreements will have an impact on future trade agreements where carbon disclosures could become mandatory as a part of a global accounting system. Measuring climate change mitigation is reminiscent of certain provisions that were contained in agreements such as the Trans-Pacific Partnership (TPP).

Put simply: the world needs global leaders to build regulations and new disclosure requirements to bend the climate curve. Yes, new rules can cost jobs. But, they can also unleash a century of innovation and social growth.

Sustainable investing to see explosive growth

Climate scenario models in focus

We are at an inflection point. Morningstar reports that sustainability-aligned funds received nearly $21.5 billion of net inflows in Q1 of 2021—more than double the inflows of the same period of 2020 and 5 times that of 2019. A similar trend is seen with passive sustainability funds, which claimed nearly $15 billion, or 70% of all U.S. sustainable flows. In addition, as of the end of 2020, the U.N.-backed Principles for Responsible Investment (PRI) reported AUM of more than $103.4 trillion and 3,300 signatories, a majority of which fall within our client profile.

Below is a list of recent acquisitions dating back to October 2019 by large asset managers and data providers positioning in the market.

Figure 2.

One of the significant drivers for this market shift is recommendations promulgated by the Task Force on Climate Change Risk Disclosure (TCFD). In 2017 the TCFD began promoting the application of climate change scenarios into climate change risk methodologies. Today, TCFD recommendations have been broadly adopted by over 60% of the world’s largest companies and have become the template for regulators in many jurisdictions where climate disclosure is now mainstream.

The use of scenarios in measuring climate change risk is at the heart of the predictive value of the Entelligent model. The TCFD and now the world’s largest companies have moved in this direction is both a tremendous validator of what we provide and a transformational shift.

Here is why: Initial efforts to include low-carbon strategies in portfolio allocation required applying a carbon footprint analysis. Companies were asked voluntarily to calculate and disclose their Scope 1, 2, and 3 emissions profiles. Investors would then calculate their emissions based on the percentage of their ownership. The simple logic for assessing risk was the greater the carbon emissions, the greater the risk. The lower the emissions, the lower the risk.

The 2017 TCFD recommendation for the application of scenario analysis in addition to carbon profiling would allow asset managers to redefine carbon risk as either (i) a deviation of a portfolio in a given future climate scenario (so the greater the deviation, the greater the risk) or (ii) the sensitivity of a portfolio to extreme future climate scenarios (so the greater the sensitivity, the greater the risk).

This brings the story right into the engine room of Entelligent’s approach and our patented technology. Our scenario modeling is what makes our patented methodology forward-looking, sourced from science and transparent.

Our climate change scenarios are derived from information and data from thousands of climate scientists as part of the U.N. efforts to advise stakeholders on projections of future greenhouse gas emissions. This means our investment analysis is coming from the same sources as those that are informing regulation. We think this may align users of Entelligent data with the coming regulatory curve. Also, these climate scenarios are based on data and factors such as future population levels, economic and energy modeling, and patterns of technological change—all of which are inherently forward-looking.

Before Entelligent’s work and the TCFD recommendations, standard practice for measuring climate change risk, as stated above, depended upon a company’s self- reported data and aggregated scope 1, 2, and 3 emissions profiles. These are backward-looking metrics—a snapshot of emissions generated by an already-built environment. Using such data was like navigating a car traveling 100 mph using a rearview mirror — with a massive climate cliff on the horizon.

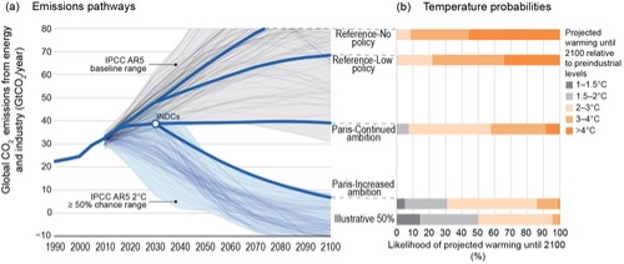

Figure 3.

Global CO2 emissions and probabilistic temperature outcomes of different policies

Getting into the nitty and gritty, at Entelligent each scenario is coded with hundreds of assumptions about energy use, supply, and demand. By decoding these scenarios, Entelligent has built a unique and powerful database to create indexes with data useful for risk management systems.

The increase in compliance requirements, along with the evolution of leadership by TCFD, G7, E.U., and signals from the U.S. Securities and Exchange Commission herald the vital need for a market solution that can simplify and standardize climate risk reporting while making it relevant for investors, as well as for the determination of company-specific, sector-specific, and global CAPEX and OPEX.

Additionally, the solution should be empowered by capabilities that optimize and align portfolios with climate and NetZero commitments. In this regard, climate scenarios can be useful for investors seeking to implement sustainability strategies.

More significant disclosure requirements will profoundly impact Entelligent’s value proposition

Updates on the innovations and commercialization of the Entelligent approach

We believe Entelligent is well-positioned to benefit from the shifting regulatory landscape and the massive increases in ESG AUM. As a result, we are investing in expanded product offerings, both in terms of applications and across asset classes.

We have developed a new Transition Risk score focused on climate alignment rather than climate resiliency (E-Score). The new “T-Risk” tracks climate alignment closely and utilizes fundamental information on scope-1 and scope-2 emissions.

We are also planning to release climate risk scores targeted to Fixed Income markets by the end of Q3 2021. We see tremendous opportunity as the F.I. market representation is at ~$119 trillion worldwide and ~$46 trillion for the U.S. We see increasing demand for climate transition finance. Speed to market is important, so we are processing in parallel—product development, client engagement, and I.P. application & strategy—working with FactSet (NYSE: FDS), our strategic data provider, to expand our offerings through our OpenFactSet portal.

We are also continuing to license our fund strategies and data to some of the largest asset managers and beginning work on an enterprise risk management system solution for the wealth management segment.

Customer engagement around the massive growth in assets includes building modelled strategies for signed clients such as Société Générale, Promethos Capital and Alerian.

We are also planning, with several leading prospective clients, to target the $6.1T 401(k) and $20T RIA markets. We feel the long-term nature of retirement accounts and the heightened regulatory touchpoints make them ideal for climate conscious investing.

We are also exploring fund concepts with some of the biggest asset managers in the world. These product lines specifically address a landscape with increasing regulation, the need for data and analytics that align with climate change scenarios, and the need for new funds that advance investors’ alignment with sustainability. We believe that we have created a database and analytical tools that can provide asset managers with unparalleled ability to innovate in the sector.

From that place of confidence, and in our view that robust innovation only benefits the cause of saving the planet, we believe that all should welcome competition over ideas and approaches. While some clamor for a more unified and regulated set of standards, each method has unique characteristics.

Market activity is validating our proposition.

One market development worth sharing is the June 2021 acquisition of Baringa by BlackRock, intended to incorporate climate modeling into Blackrock’s Aladdin platform. Before this acquisition, BlackRock had also announced two new climate change funds, including an Exchange Traded Fund (ETF), which was publicized as the largest newly launched ETF in history.

We see these developments at BlackRock as a validation of our business model. In an effort to capitalize on that, Entelligent and its staff are prioritizing development activities and seeking to ensure its competitive advantage, including periodic reviews of our patent and intellectual property rights—always in the spirit of keeping the entrepreneurial marketplace of ideas open.

Entelligent has provided its comments to the U.S. Securities Exchange Commission on possible policies for climate disclosure. The thrust of our comment is that we want the market to join us as we uniquely seek to compete where our origin story starts—from the application of science and an entrepreneurial vision of providing new tools to the market where pursuing a sustainability strategy is not contrary to a fiduciary duty or pecuniary interests, but integral to it.

Building a global Entelligent brand.

We are pressing forward to get our message out. Our staff is working to sharpen and amplify our own brand story. We are gathering all the elements of how we describe ourselves, finding what is missing and what can be improved. We are not Blackrock or Bloomberg; we are Entelligent! We have a unique story and a mission that will resonate and carry us a long way to success if we communicate well. These efforts will enable us to go bigger and bolder, in a unique and differentiated way, to ESG market participants globally.

One branding area with particular ROI leverage is a focus on joint marketing efforts with our current partners. We are working to arm SocGen, Promethos, FactSet et al. with powerful messages to carry the Entelligent story far and wide, helping them enable sell-through. We will be digging deep with partners to ascertain how to provide them with the suitable materials and help them seek to drive AUM and subscriptions.

The marketplace will see more and more from Entelligent. We have joined critical organizations like the United Nations Environmental Program UNEP as a signatory to sustainability principles. We are not investors. We are data and analytics providers. But our job and mandate are to commercialize a technology that can empower investors seeking a path toward sustainability and climate stability.

Looking through the Entelligent lens at the pandemic shock

Outperformance through COVID 19

Our value proposition starts and stops with risk. Entelligent’s use of climate change scenarios allows investors to plan for potential shocks from climate change-related events ranging from a rising global temperature and a transition to regulations and policies to limit greenhouse gases. Our platform allows investors to back-test these strategies for up to 15 years of history. Our modeled strategies enable banks, asset managers, asset owners, and insurance companies to create measurable shifts in their financial and environmental impact.

However, many investors have asked how such strategies have recently performed, such as during the COVID 19 pandemic. Below is a graph of the S.G. Climate Risk Control Index (USD – Gross Total Return) performance compared to the S&P 500 Min Volatility Index. Note that the S.G. Climate Risk Control Index powered by Entelligent has outperformed the best comparable index by more than 200 basis points year to date (11.5% verses 9.10% total return year to date).

I hope I have been able to convey to you my optimism, both for Entelligent and humanity. It has been tremendously rewarding to see the sustainable investing world bend in our direction. The reason we were here first is because we were born out of science. In my next communication, I hope to share the outcome of our efforts and the unique relationships we are envisioning for our future.

Best regards,

Tom