Entelligent announces the release of T-Risk 2.0, which delivers several important enhancements to its patented methodology. T-Risk 2.0 delivers significant calculation process enhancements that increase the utility and analytical power of the T-Risk score. The changes were specified and implemented as part of Entelligent’s continuous development and improvement cycle, in collaboration with our community of development partners and customers.

Technical Updates

Extreme outlier removal. T-Risk 2.0 further advances Entelligent’s objective of efficient market analysis by removing extreme outlier stocks, which financial institutions and investors are unlikely to hold or evaluate. We achieve this in two ways:

Data clipping: T-Risk 2.0 filters out very small (market cap < $1M) and very thinly traded or untraded issues. It also sets a minimum carbon-emission threshold of 1 metric ton.

Data transformation: T-Risk 2.0 handles remaining outliers via Gaussian transformation. This eliminates value “clumping” within industry groups, among other things.

Continued reduction of carbon estimation in Carbon Adjusted T-Risk. Avoiding a critical weakness of most climate data algorithms, the T-Risk methodology only adds carbon factors after T-Risk scores are calculated, at which point cohort-median carbon data is applied across sectors as part of the Carbon Adjusted T-Risk calculation.

T-Risk 2.0 further narrows the conditions under which estimated data is applied — using median scores only within sectors and only for cohorts a) with > 50% carbon-data coverage and b) when sample size with carbon data present is > 10 assets in a quarter.

Improvement of Carbon-Adjusted T-Risk. T-Risk 2.0 also improves the weighting of carbon footprint in calculating Carbon Adjusted T-Risk, by applying Gauss rank transformation.

Benefits and Impacts

- Improved analytical transparency. T-Risk 2.0 enhances the model’s noise reduction methodology, resulting in smoother, more stable scores, with increased comparative power and predictive value for climate risk assessment.

- Improved distribution of outcomes. As part of T-Risk 2.0’s enhanced noise reduction, we remove extreme outliers before the modeling step to yield a more normal distribution of outcomes. This improves the model’s analytical value, making it, for example, easier to understand how companies’ risk assessments relate to each other, within and across industries and regions.

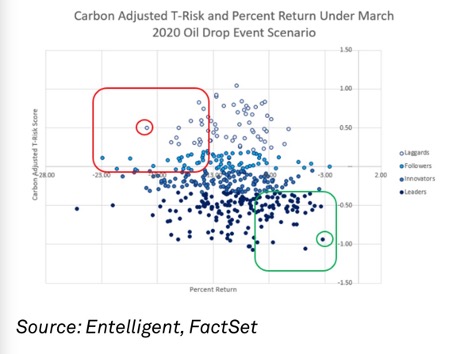

- Increased relevance to financial institutions and investors. Already a superior tool for financial applications — because its outputs are returns and valuations-based (measuring climate change’s impact on markets rather than the reverse) — T-Risk’s new release extends that advantage. T-Risk 2.0’s improved analytical transparency makes T-Risk data more relevant in investment and financial use cases, by enabling more granular risk assessment and outcome projection under energy transition scenarios.

- Improved usefulness in reporting and compliance. T-Risk 2.0 is better positioned to support compliance applications, including management to internal and external standards. Specifically, T-Risk 2.0’s improved intra-industry and intra-region analytic capability better enables those pursing sector-inclusive strategies to validate and report investment rationales.

- Continued strong performance. T-Risk 2.0’s enhancements come at no cost to its performance as a risk management tool.

Join the discussion One Comment