March 23, 2023 | Boulder, Colorado — Entelligent’s T-Risk, a unique climate transition score that enables risk management and opportunity identification, took a quantum leap forward this week with the launch of T-Risk Multi-Scenario. The expanded functionality, part of the newly released T-Risk version 3.0, adds three new climate scenario options — which significantly increase the score’s value and relevance for risk management and regulatory compliance applications.

The new release also incorporates expanded data across other critical dimensions of T-Risk. Taken together, T-Risk 3.0’s enhancements put exponentially more power and versatility at the disposal of professionals in financial product development, portfolio management and investment analysis.

T-Risk, a score within Entelligent’s patented Smart Climate® data and analytic suite, is available on the FactSet Portfolio Analysis workstation. The new release is a milestone on the company’s roadmap of continuous innovation and IP development, building on its patented methodology, and advancing the critical field of climate-sensitive investing and risk management.

The Smart Climate® suite uniquely addresses key regulatory frameworks, including the EU’s SFDR Article 8, TCFD, and the U.S. Federal Reserve’s Climate Scenario Analysis. Smart Climate’s® relevance to such frameworks is backed up by its patented methodology, which specifically covers the use of scenario modeling and enables mandated transparent reporting.

Further details about T-Risk v. 3.0’s enhancements follow here:

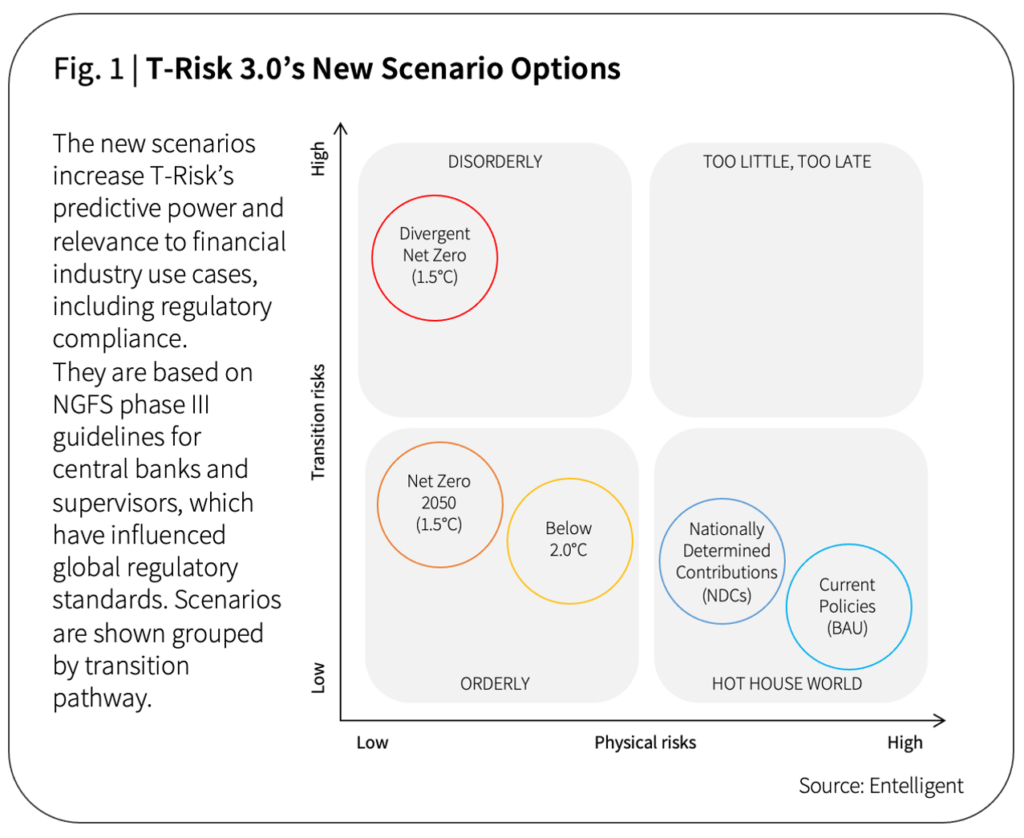

Comprehensive scenario options. T-Risk, a directional score that measures the return spread for a given equity between business as usual (BAU) and an alternative scenario, previously offered one alternative scenario option: the Net Zero 2050 (or Paris-aligned) scenario. T-Risk’s option set now also includes: Nationally Defined Contributions (NDC), Net Zero 2050 Divergent and Below 2°C. (BAU is now known as Current Policies.) Scenarios are defined according to NGFS phase III guidelines for central banks and supervisors, and reflect a spectrum of policy ambition, reaction, technology change, carbon dioxide removal and regional policy variation. They are grouped by transition pathway: orderly, disorderly or hot house world. (See Fig. 1, below.)

- Deeper historical coverage. T-Risk 3.0 has adopted RBICS industry classifications for cohorting to gain historical depth (growing in coverage from ~36,000 securities to ~39,000 for the most recent quarter). This change notably expands T-Risk’s back-coverage of Asian and North American equities, as well as small and micro-cap stocks, and most indices.

- Expanded projection window. The T-Risk methodology, which begins with integrated assessment model (IAM) data, now employs 10-year forecasts (instead of 2-year, as before) to uncover further performance differences and energy price sensitivities.

- Improved performance. T-Risk 3.0 has demonstrated performance improvement versus benchmark indices as compared with T-Risk 2.0, in backtests performed by Entelligent.

About Entelligent:

Entelligent is an independent technology company that has developed proprietary and patented technology to analyze forward-looking climate scenario models to improve risk-adjusted returns for institutional investors. Entelligent was the first company to be granted a patent over the use of climate scenario analysis in climate-risk assessment for security selection and other financial products. Entelligent’s data analytics platform addresses the lack of clear, tangible metrics to provide a roadmap for effective climate risk investing, while allowing the capital markets to make a positive impact on climate change. Its portfolio of solutions — including Smart Climate®, E-Score® and T-Risk — deliver climate change risk metrics for securities and portfolios, and enable companies and institutions to meet emerging climate regulatory requirements. For more information, visit www.entelligent.com.

For more information, contact:

Hadrien Moulinier

Chief Revenue Officer

Entelligent

hmoulinier@entelligent.com