Entelligent® is the first to develop and be granted a US patent for using scenario analysis in a technology that assesses climate-related risks. This gives Entelligent and its licensees the advantage of an exclusive, patented methodology in security selection and index construction using scenario-based climate-related risk assessment. These elements can in turn be included in financial products that will stand out the marketplace.

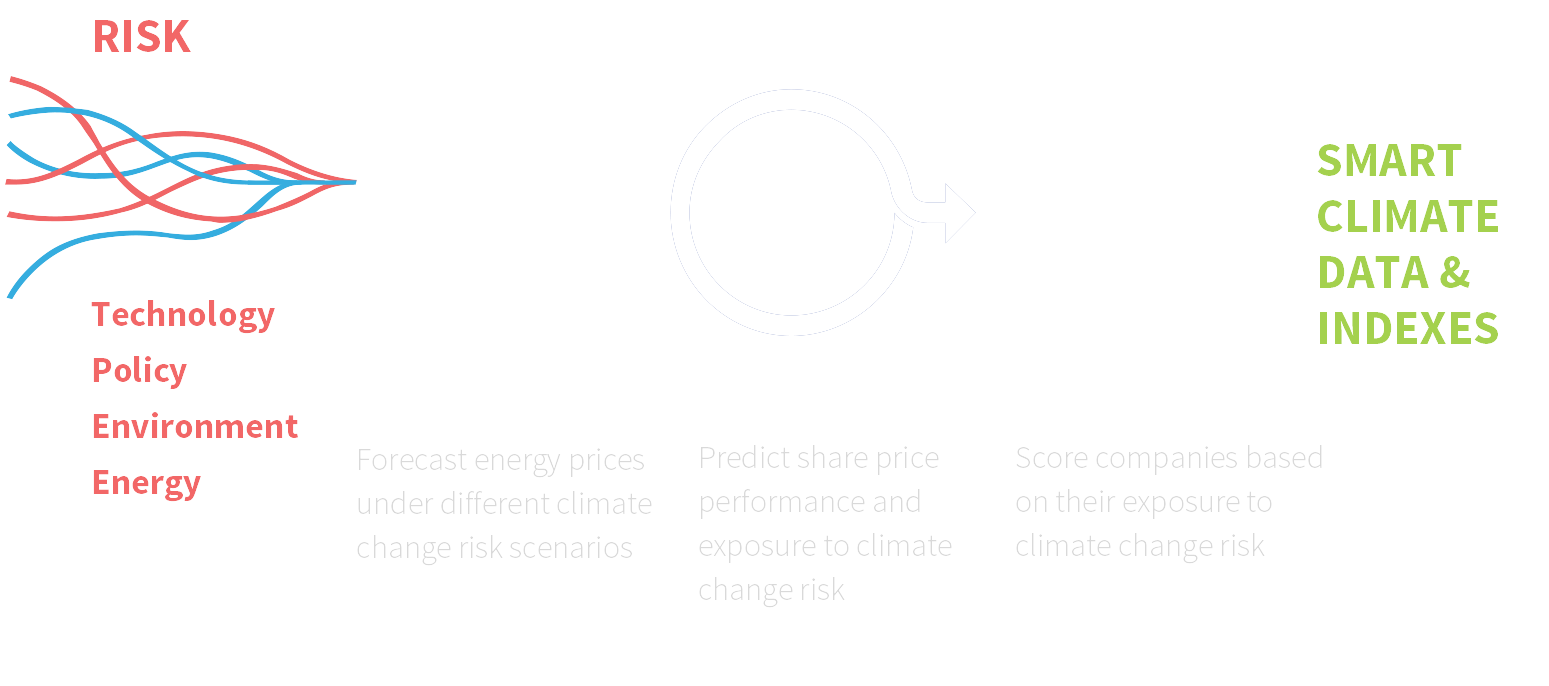

Our transparent data platform examines the impact of new laws and regulations, new technology, and energy transitions to calculate energy costs and profitability and their granular impact on each company. Companies that are likely to maintain their return forecasts in most scenarios are given superior scores.

E-Score® Database

E-Score is a measurement of climate change risk derived by comparing public securities’ performance (e.g. XOM, APPL) to expected profitability streams of primary energy sources (e.g. coal, oil, renewables) under different climate scenarios. These relationships are carried forward to forecast future returns of individual securities.

Energy prices and profitability streams are estimated using system modeling that considers various socio-techno-economic factors related to climate adaptation and mitigation. Factors can be rolled-up to produce global temperature targets aligned with the Inter-governmental Panel on Climate Change scenarios. The dispersion of forecasted returns under multiple climate scenarios are then standardized as a measure of risk — Energy Mix Transition Risk. EMTRs form the basis of Entelligent’s E-Score.

Competitive Landscape

The marketplace is awash in data and yet it is difficult to consider systemic risks like climate change. Much of climate risk analytics, including carbon foot-printing or alignment with a particular climate future, is derived from historic financial statements and thus is inherently backward looking.

Share prices reflect market expectations on how well businesses are positioned to perform in the future. To effectively integrate climate change risk and opportunity therefore requires a forward-looking approach that considers different climate scenarios.

The forward-looking approach helps investors identify the stocks that are undervalued and a better fit for climate and energy-related transitions. Entelligent has created a groundbreaking predictive data platform that is consistent with how markets really operate.

Why It’s Different

-

Identifies firms in every sector with the greatest potential for Total Impact — environmental and valuation impact — in the transition to a low carbon economy.

-

A top-down approach using climate change scenarios and their relationships to different energy pathways to assess security-level climate risk exposure.

-

Forward-looking scenarios for climate risk assessment as recommended by the TCFD.

-

Science-based methodology that allows for both passive and active portfolio management strategies.

-

Scores that are additive and can be easily integrated with other global ESG and financial selection metrics.