By Pooja Khosla, PhD, Chief Innovation Officer, Entelligent

Carbon emissions data — still a mainstay of climate change policymaking and risk management — may be hurting us more than it helps us. I wrote about one of carbon’s biggest problems in a recent commentary on MarketWatch — specifically zeroing in on the large body of research that shows how inaccurate and subject to manipulation carbon data is.

Today, I’m sharing the rest of the story. Here are four more reasons why regulatory agencies, asset managers and financial institutions can’t rely on carbon emissions data to manage climate risk.

1. Calculating carbon emissions is an accounting exercise, not a scientific or risk management exercise. To understand this, we need look only at the automobile industry, which reported virtually no decrease in Scope 3 data in 2020 vs 2019 — even though most cars sat idle while drivers stayed home during pandemic quarantines. The data hardly budged because automaker carbon accounting is based on amortization — and assumes a continuous active product lifespan — rather than measuring or estimating actual use.

2. When it comes to climate mitigation, carbon data creates false incentives because offsets are often unevenly priced, unrealistic or exaggerated. Delta Airlines in 2020 bought offsets for $2.50 a ton, while Bill Gates paid $250.00 a ton for his private jet. Reforestation is currently overestimated as a climate change solution because reclaimable land is in reality limited. Some land counted for offsets could never have been commercially exploited, e.g. because it is too hard to get to.

3. Carbon data doesn’t tell the whole story. It describes how companies impact their environment but lacks the full perspective that climate-aware capital allocators require. For example, it considers the abatement costs to expenses but not the impact to revenue. And it doesn’t address how climate change will impact companies in the future — including the impacts of technology innovation, shifts in demand, etc. — which represent the majority of transition risk.

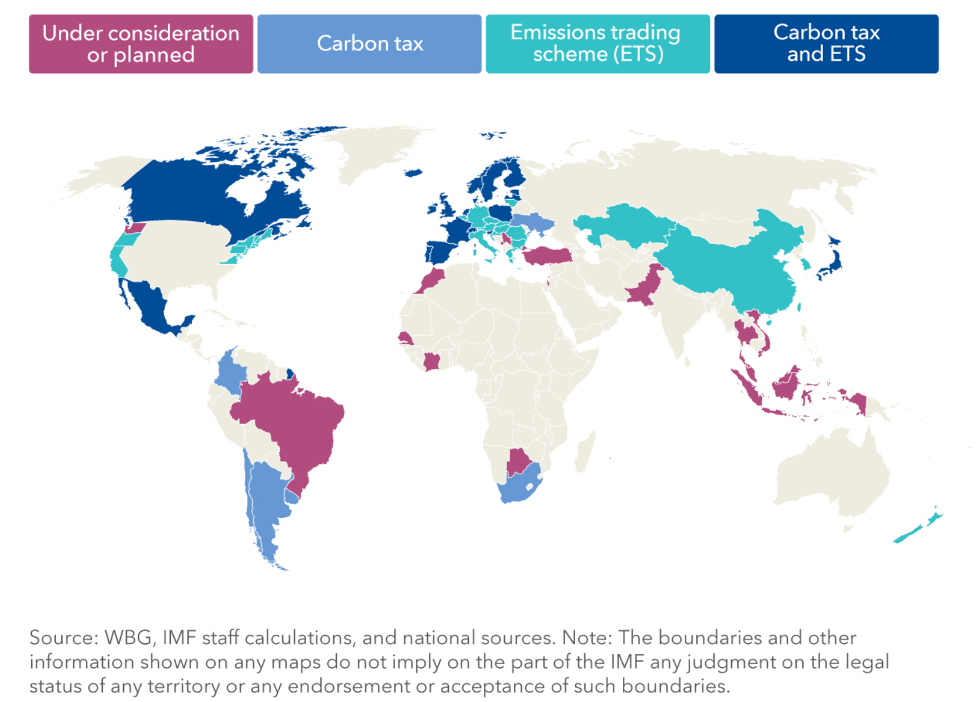

4. Carbon data lacks financial materiality — because most of the world hasn’t adopted carbon pricing yet. As a result, carbon data doesn’t enable standardized, comparable across regions and sectors — which is critical to financial analysis. Regulators (such as OFSI) are trying to raise quality and establish consistent pricing — but the process is slow and won’t generate the historical data investors and risk managers need, in any case.

Bottom line: Policymakers, investors and risk managers must view the climate transition through a wider lens. They must think about the impact climate change has on companies (rather than the other way around, as many often do) — and account for the impact of technology innovation, regulatory shifts, and global energy supply and demand play in the future performance of assets and investments.

Join the discussion One Comment