By Pooja Khosla, PhD., and Thomas H. Stoner, Jr. Originally published by GreenMoney.

For investors concerned about climate change risk, the issue of which stocks to buy, hold and sell can be quite complicated. The power sector representing the largest consumer of carbon fuels is highly regulated. When plants are decommissioned, rates are typically raised to cover the cost of investment in replacement plants and equipment. Investors must understand the risks to a company that might end up with a stranded asset. When there is adequate cost recovery, it represents a cost to users, but it’s often a benefit to shareholders. The tension for regulators is striking the right balance.

More deeply, data that measures climate risk – and penetrates sector-level analysis to security-level analysis – can be vital for investors who want exposure to the power sector while minimizing transition risk to a lower-carbon future.

Before we review what this data reveals about sectors and stocks, consider the consequences of regulation. Regulation, after all, is crucial for addressing climate change. U.S. Environmental Protection Agency rules can accelerate the transition to cleaner energy sources and encourage the adoption of technologies that reduce greenhouse gas emissions and make net zero goals real.

On the other hand, there’s concern that excessive regulation creates an unnecessary bureaucratic burden, diverting resources from innovation, infrastructure development and energy security. That last factor is the most important for a nation’s economic stability, as well as its defense, geopolitical influence, environmental sustainability and resilience.

It is also argued that stringent EPA regulations can impose excessive financial burdens on power plants, leading to higher costs for electricity generation. This may impact the affordability of energy and harm certain sectors of the economy. In addition are the concerns that strict regulations place U.S. companies at a disadvantage.

Companies will need to reevaluate their priorities to align with proposed government standards. They may need to emphasize investments in control technologies, such as carbon capture and storage, or low-GHG hydrogen co-firing, to meet emissions reduction requirements. This could result in a shift away from fossil-fuel-based infrastructure toward more sustainable technologies.

Compliance would require companies to make investments in retrofitting power plants or constructing facilities with the necessary control technologies, or ones that provide a variable power source, which could cause financial strain. The proposed standards introduce regulatory and policy risks and may accelerate the renewable transition. Regulations may promote and even incentivize companies in certain regions to invest in renewable projects, energy storage and low-carbon technologies. Such regulations can dramatically alter the power sector’s business model, exposing it to new risks.

These scenarios suggest asset managers should consider several factors when building portfolios. The bar of caution is high and the need for adequate actionable data to validate investment decisions is greater than ever. Monitoring technology adoption and innovation, staying current on the regulatory landscape and assessing companies’ renewable energy transitions are essential. By considering these factors, investors can best navigate the impact of proposed EPA standards and make informed choices.

EPA regulations and company-level case studies. The regulations aim to reduce emissions, meaning companies operating in the power generation and fossil-fuel sectors face greater scrutiny and potential challenges in meeting standards. According to forward-looking Entelligent E-Scores, including T-Risk, that consider such policy responses, we find energy companies such as EQT Corp. more pressured by regulation relative to APA Corp. and Phillips 66, per Q2 ’23 estimates. (EQT is focused on natural gas production, APA on energy infrastructure and Phillips on refining and marketing.)

APA and Phillips are more diversified compared to EQT, which could provide a cushion. Consider the relative riskiness: Natural gas companies may be riskier than oil companies in the transition to a fossil-fuel-free energy mix. The shift toward renewables and decarbonization are expected to decrease the demand for natural gas, a fossil fuel. On the other hand, oil companies are facing similar challenges, but the extensive demand due to market pressures will likely decline more gradually. This means the short-term risk for natural gas companies may be higher, but both types of companies will likely face long-term challenges as the world moves toward a more sustainable energy mix.

The Entelligent E-Score model uses security price return forecasts and information coefficient from correlations with energy sources including coal, oil, gas, renewables, etc. The investment return forecasts for multiple scenarios are updated quarterly for three scenarios: Minimum, Maximum and Business as Usual. The updates account for 10 socioeconomic conditions. With situations such as the war in Ukraine, the model captures upward (favorable) energy profitability (return) shocks and estimates the future forecast by evaluating how a carbon tax or subsidies for renewables could impact the profitability or returns of companies up to two years out. In situations like these due to market conditions, diversification and relatively less short-term risk, it is very possible that E-Score rankings are favorable for the energy sector, particularly energy companies like APA and Phillips.

Consider these findings:

PG&E Corp. (Screened In): Considered more carbon intensive due to its historical reliance on natural gas and coal. However, PG&E has been actively incorporating renewable energy and reducing emissions to meet the tight regulatory environment in California. According to T-Risk, this company is relatively better prepared.

Atmos Energy Corp. (Screened In): Natural gas companies like Atmos are cleaner than coal and oil, but still reliant on fossil fuels. They have advantages in climate transitions, such as being a “bridge fuel” firm and by investing in carbon capture.

APA Corp. (Screened Out): As an oil-and-gas exploration-and-production company, APA faces significant transition risk. Its reliance on fossil-fuel reserves makes it vulnerable to potential asset devaluation in a carbon-constrained future. Carbon-intensive operations expose it to regulatory and market risks. Due to nonbinding regulations and high fossil-fuel dependency, APA is screened out from the portfolio for the current quarter.

Phillips 66 (Screened Out): Engaged in refining, marketing and distribution, with significant operations in Texas, California and Oklahoma. Texas and Oklahoma are far behind in formalizing climate-related regulatory frameworks. This company is also screened out of the portfolio to hedge climate transition risk.

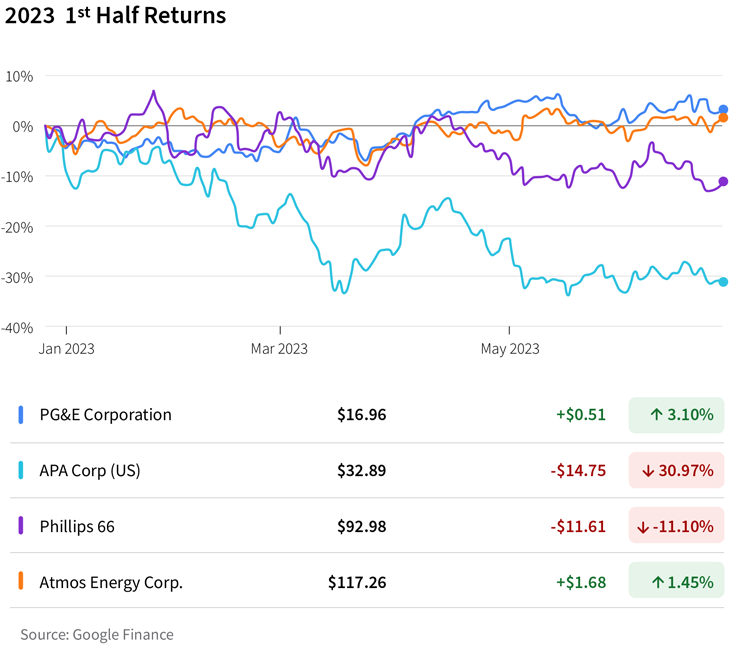

Thus far in 2023, coal and oil prices have tumbled. T-Risk carbon-adjusted screening helps to hedge against energy demand and price disruptions. It is likely that the companies less exposed to these two fossil fuels – due to the nature of their business (Atmos) or regulations and green incentives from states (PG&E) – are outperforming, as shown in the graphic below.

Consider T-Risk screening of prominent energy companies Baker Hughes Co. (screened in), TotalEnergies SE (screened out) and Equinor ASA (screened out). Baker Hughes is regarded as potentially less risky than TotalEnergies and Equinor in terms of energy transition and security issues in global markets, including the EU, amid several factors.

Baker Hughes is less risky due to diversification, reduced fossil-fuel exposure and adaptability to renewable energy. It can serve both traditional and renewable sectors, reducing reliance on declining fossil fuels. By not being as involved in oil-and-gas exploration and production compared to TotalEnergies and Equinor, Baker Hughes is less exposed to energy-related geopolitical disruptions and energy security issues.

While TotalEnergies and Equinor are actively diversifying into renewables, which could position them favorably in the EU’s transition to a low-carbon economy, in the T-Risk two-year forecast Baker Hughes’ focus on oilfield services may provide a degree of insulation from energy security and transition issues. Six-month return projections show the T-Risk Carbon Adjusted metric benefited with hedging by screening in Baker Hughes to the benchmark portfolio and screening out riskier companies such as TotalEnergies and Equinor.

In conclusion, when new emission reporting standards were introduced, it created expectations that reporting would greatly improve, leading to the creation of more comparable and measurable information for the markets. If you are a believer in efficient market hypothesis, as we are, then when investment information gets better, decisions on building portfolios get better. In this case, that likely means better performance for two vital metrics: sustainability and investment returns.

Article by Dr. Pooja Khosla, CIO and Thomas H. Stoner Jr., CEO, Entelligent

Pooja Khosla, Ph.D., is Chief Innovation Officer at Entelligent. She is an economist, econometrician, mathematician, and thought leader in the sustainability and climate finance space and has deep knowledge of building sustainable investing solutions. Dr. Khosla earned a Ph.D. in economics and has master’s degrees in four disciplines.

Thomas H. Stoner Jr. is CEO of Entelligent and one of the company’s co-founders. Mr. Stoner has co-founded three cleantech and renewable energy companies and served as CEO of two publicly traded companies. He received a master’s degree in finance and accounting from the London School of Economics.