What Happened

The European Central Bank (ECB) warned approximately 20 banks that they would be fined if they failed to improve climate risk management. The warnings followed the ECB’s assessment that the banks were not adequately prepared for the potential financial impact of extreme weather events and the risk that clients with large carbon footprints might go out of business.

The proposed fines would accumulate daily, may run as high as 5% of a bank’s daily average revenue, and could continue for up to six months if a bank fails to adequately address the original infringement.

What It Means

The ECB’s action escalates the authority’s approach to enforcement. It follows ECB Supervisory Board Vice-Chair Frank Elderson’s public comment earlier this month that “none of the banks under our supervision fully meet all of our expectations.”

The 20-odd banks now under specific warning had failed to meet a March 2023 interim deadline to perform a materiality assessment of climate and environmental risks in their portfolios. Each now has an individual deadline to remediate, according to Bloomberg, before fines take hold. More broadly, the ECB rules require all of its regulated institutions to fully comply with its ESG standards by the end of 2024.

What’s Next

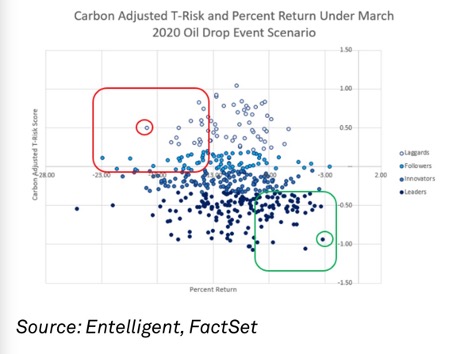

Entelligent’s Smart Climate Fundamentals solution — part of the Smart Climate data analytic suite — can help banks meet climate risk compliance requirements. Among other things, Fundamentals applies Entelligent’s T-Risk transition and physical risk model to company-level income statements and balance sheets to give banks the data they need to analyze, track and report portfolio performance across multiple climate transition scenarios. Our solution is designed to work hand-in-hand with banks’ internal credit rating models. Contact us to find out more.