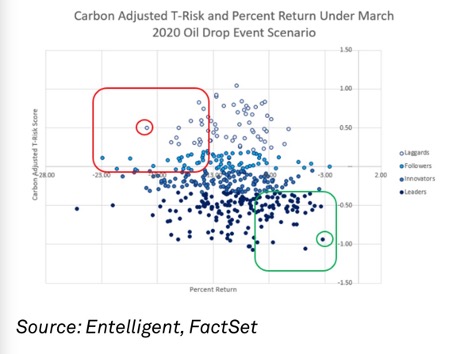

www.entelligent.com/case-studies/trisk-energy

Inside This Report: This new case study by Entelligent (16 pages, with 15 figures) analyzes the exposure of public energy stocks to a range of possible energy pathways as measured by Entelligent’s T-Risk score, with focus on the period leading up to and after the global price shock brought on by the Russo-Ukraine war.

The study makes inferences about the relationship of energy companies’ T-Risk performance to their business activities and the broader market environment, evaluating their transition-readiness individually and as members of industry and regional groups. It demonstrates the explanatory power T-Risk can provide for its users, even in extreme scenarios, as well as its usefulness in portfolio evaluation and construction.

We conclude with a performance backtest and briefly address the implications of our observations for future energy company returns.